Analysts—especially for B2B vendors—can make or break performance in a market.

Businesses use industry analysts to inform their buying decisions and keep them apprised of industry trends. Particularly for enterprise organizations, companies not recommended by industry analysts will not even make the short list for vendor selections.

Analysts—especially for B2B vendors—can make or break performance in a market.

Vendors use analysts to keep them informed of what is happening in the market, and provide feedback on messaging and product development. Additionally, vendors rely on analysts to understand their product and make suitable recommendations to businesses when appropriate.

To manage relationships with analysts, companies generally turn to their communications team. Good analyst relations teams will facilitate briefings, schedule inquiries, and ensure their company stays top of mind for their industry analysts when developing research and speaking to clients.

However, analyzing these relationships can be difficult.

While it’s an analyst’s responsibility to be unbiased, there is no question that an ongoing relationship benefits the vendor. The more the analyst understands your vendor capabilities, the better they can communicate it to customers.

“There is no question that an ongoing analyst relationship benefits the vendor.”

The complexity of these relationships generally leads to a qualitative analysis of the relationship. In an effort to apply more quantitative facts to our analyst relations efforts at Kapost, we developed a point structure to indicate if our relationships with each analyst are in excellent, good, fair, or poor condition.

In this blog series, we will walk you through our analyst relations’ process and what we have learned from putting a more detailed lens on our efforts.

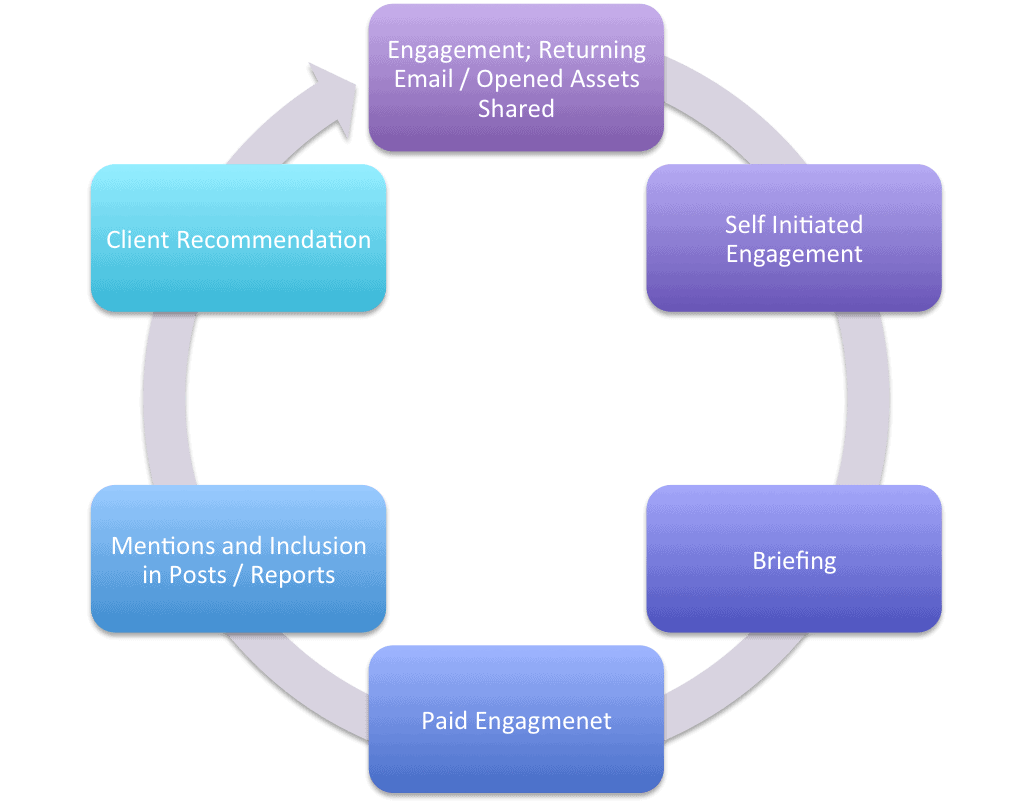

The Analyst Relationship Lifecycle

To begin the process of analyzing these relationships, it is important to look at the analyst relationship lifecycle. Through our experience, we have broken the lifecycle into six major milestones:

- Engagement: Direct returned contact from the analyst (talking on the phone, returning an email, responding to a LinkedIn message, etc.). This milestone indicates that the analyst has personally engaged with you or your brand, and has at least awareness of your brand.

- Self Initiated Engagement: The analyst initiates the conversation (calls, emails, LinkedIn message). This milestone indicates that the analyst has an understanding of your brand and finds value in communicating directly. This could be requesting additional information on your brand, customer references for a report or asking for your input on a report.

- Briefing: The analyst accepts or requests a formal briefing on a topic or demo of your product. This milestone can often come before a self initiated engagement, and sometimes—depending on your relationship with the firm—even before you have engaged with the analyst. Following the briefing, the analyst should have a deeper understanding of your product and the value it brings to your customers. This is an opportunity to show off what you are working on.

- Paid Engagement: You pay for an analyst to do a report or article on a topic and include your product. Analysts will not take a paid engagement, unless they feel there is a need for and value from your offering. This milestone indicates a strong understanding of your product and alignment with your company’s thinking.

- Mention: Your brand is mentioned in an analysts’ report, webinar, article, etc. This milestone indicates that the analyst has a strong enough understanding of your offering, that they feel comfortable mentioning you in their piece. Hopefully this mention is positive but either way, this will provide you with the best understanding of how an analyst views your product. This mention could also include anecdotes from a customer who is using your product.

- Client Recommendation: Arguably the main reason companies pursue analyst relations, and definitely the hardest to measure. This milestone indicates that an analyst thinks your product is the right fit for one of their clients. However, due to client protection policies, you need to relay on the prospect telling you they got a recommendation from the firm to know if this is happening.

It is important to note that an analyst relationship is two-fold.

In addition to the analyst getting a better understanding of your product, analysts also have deep knowledge of the market and can provide invaluable insight. Often, we will run messaging, product ideas, and content past analysts before it goes live to ensure we are in touch with the market and on the right track. This feedback is generally reserved for customers of analyst firms, but it is one of the main selling points of signing a contract with a firm.

Stay tuned for my next Analyzing Analyst Relations post “Taking a Tiered Approach.”